vermont state tax withholding

Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to. Chances are the answer you need is just a click away.

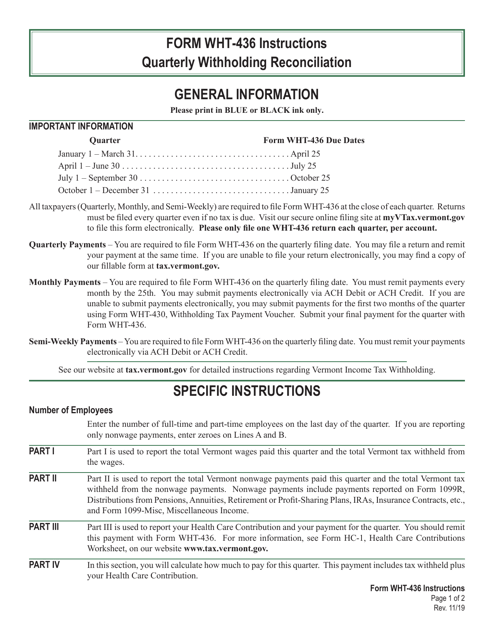

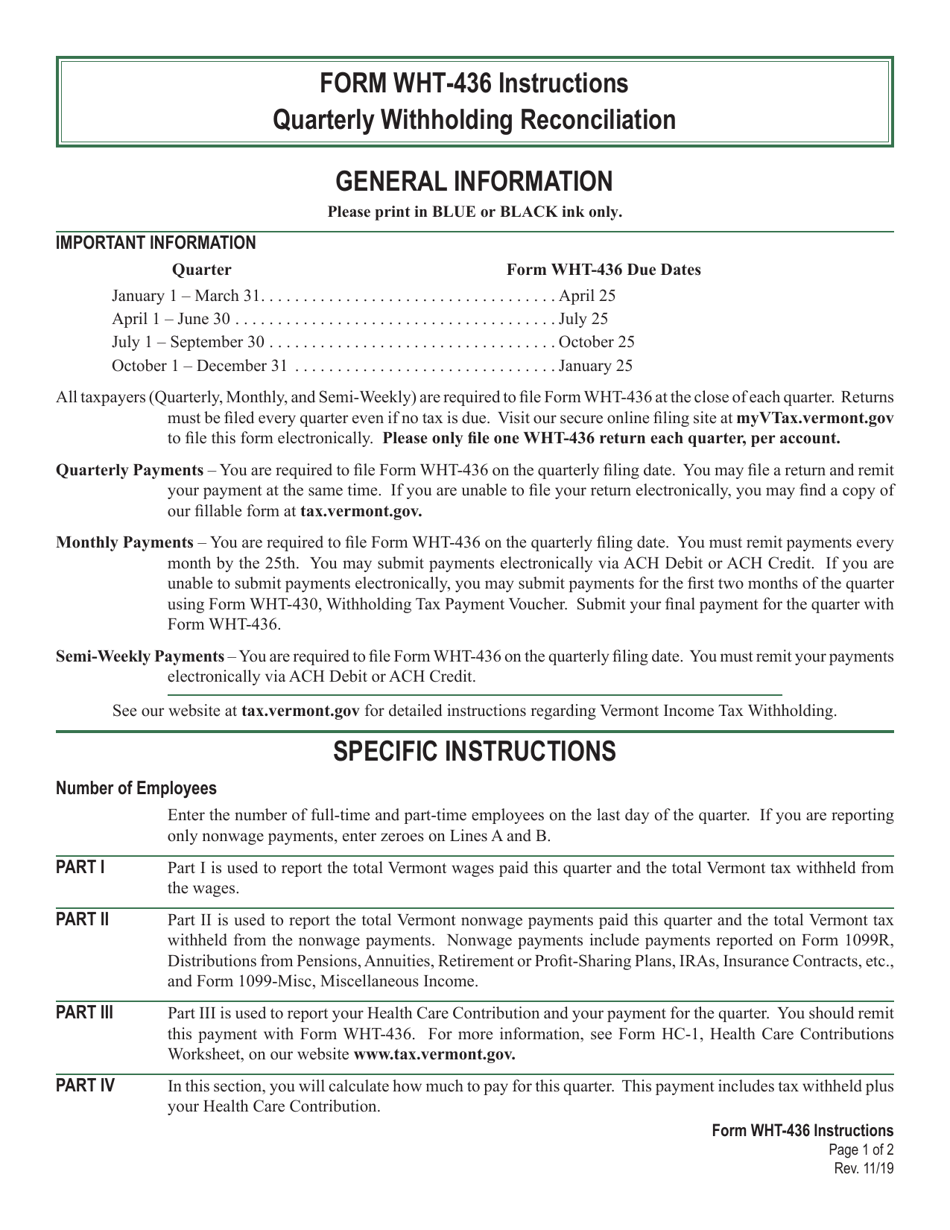

Download Instructions For Vt Form Wht 436 Quarterly Withholding Reconciliation And Health Care Contribution Pdf Templateroller

Calculate your state income tax step by step 6.

. The same manner as federal withholding tax by using the Vermont withholding tables or wage bracket charts. File My Withholding Tax. If the state withholding on the wages for the entire 40 hours is 4800 the Vermont withholding for the 16 hours is.

30 of Federal. Have Virginia state tax questions. 30 of Federal.

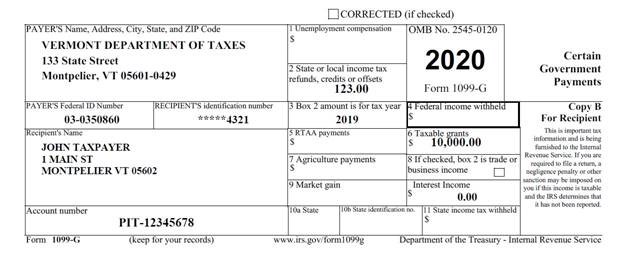

If you want to automate payroll tax calculations you can download in-house ezPaycheck payroll software which can calculate federal tax state tax Medicare tax Social Security Tax and other taxes for you automatically. 4800 x 1640 1920. If you received Form 1099-G for unemployment compensation from the Vermont Department of Labor and have questions please review information on the Department of Labors website.

If your small business has employees working youll need to understand the state law requirements for withholding. Check the state tax rate and the rules to calculate state income tax 5. 0 allowances Married with.

NON-WITHHOLDING STATE TAX WITHHOLDING There are currently ten states that do not impose a state income tax on pension and annuity income. IRA distributions are subject to state withholding at 30 of the gross payment if federal income taxes are withheld from the payment or if the IRA owner requests state withholding in writing. How Unemployment Changes by State.

Check out this list of state income tax rates that The Balance posted in January 2022. While the Federal Unemployment Tax Act FUTA must be paid regardless of where youre located it shouldnt come as a surprise that each state also has its own State Unemployment Tax SUTA rules and regulations. But if you do have a specific need that requires personal assistance weve.

50-State Guide to Income Tax Withholding Requirements Everything you need to know about income tax withholding in any state. IRA distributions are subject to state withholding at 80 of the gross payment unless the IRA owner elects no state withholding. The Vermont Income Tax Withholding is computed in.

State W 4 Form Detailed Withholding Forms By State Chart

Vermont Income Tax Vt State Tax Calculator Community Tax

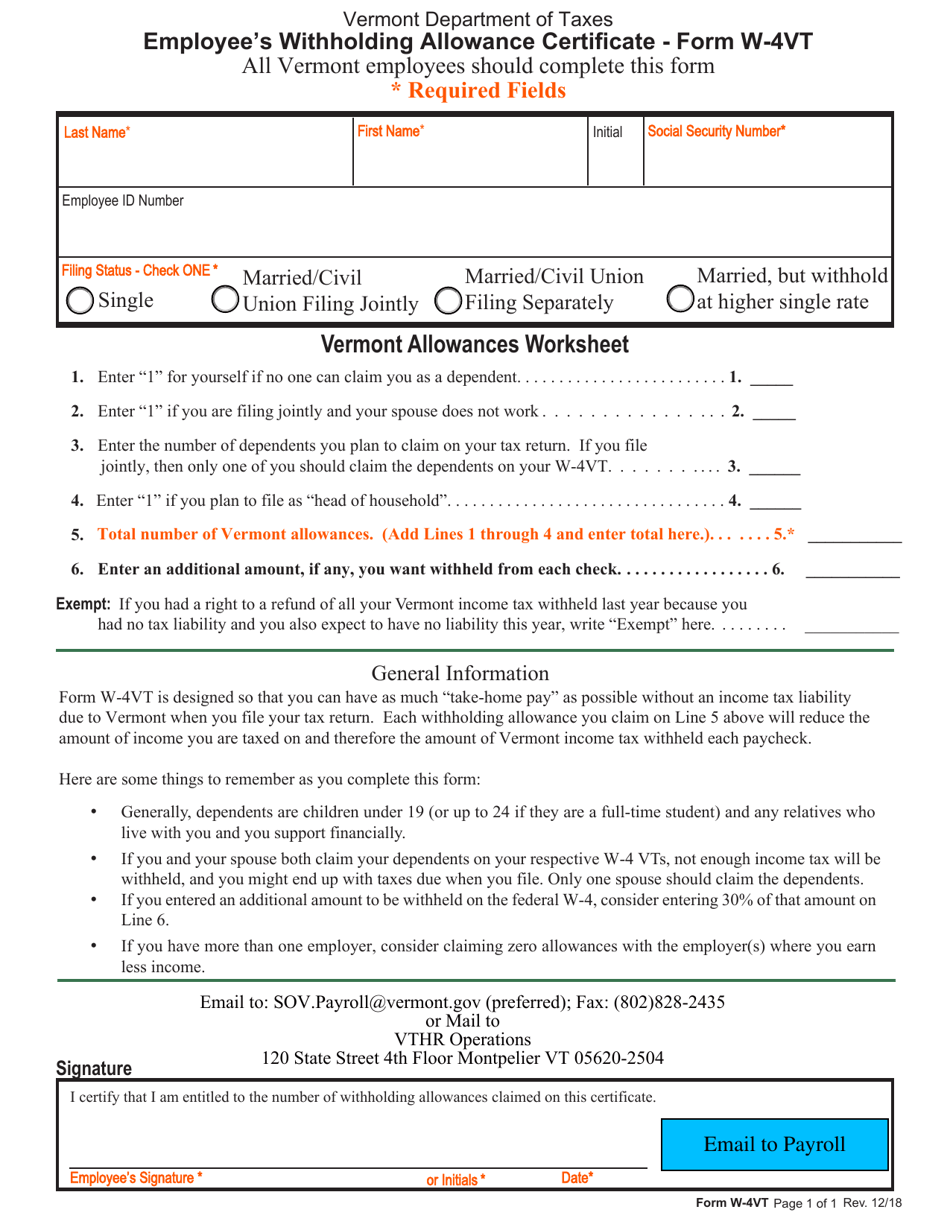

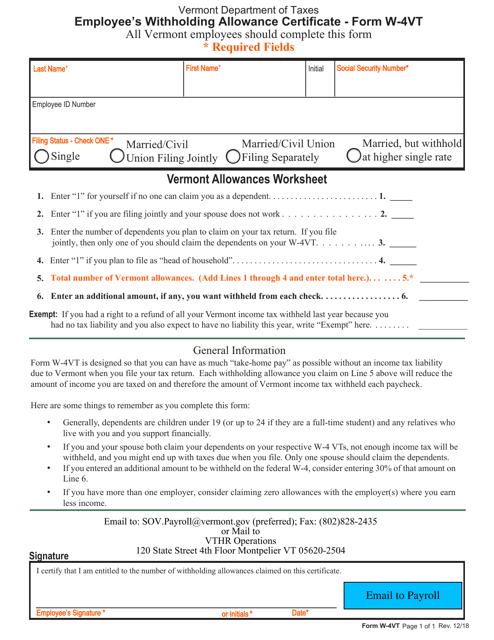

Vt Form W 4vt Download Fillable Pdf Or Fill Online Employee S Withholding Allowance Certificate Vermont Templateroller

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Vermont Department Of Taxes Facebook

Download Instructions For Vt Form Wht 436 Quarterly Withholding Reconciliation And Health Care Contribution Pdf Templateroller

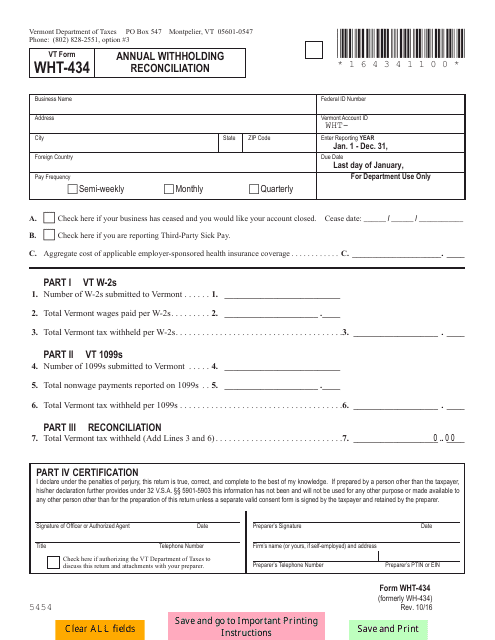

Vt Form Wht 434 Form Ead Faveni Edu Br

Vermont Income Tax Vt State Tax Calculator Community Tax

Your Tax Bill Department Of Taxes

Vermont State Form W 4 Download

Vt Form W 4vt Download Fillable Pdf Or Fill Online Employee S Withholding Allowance Certificate Vermont Templateroller

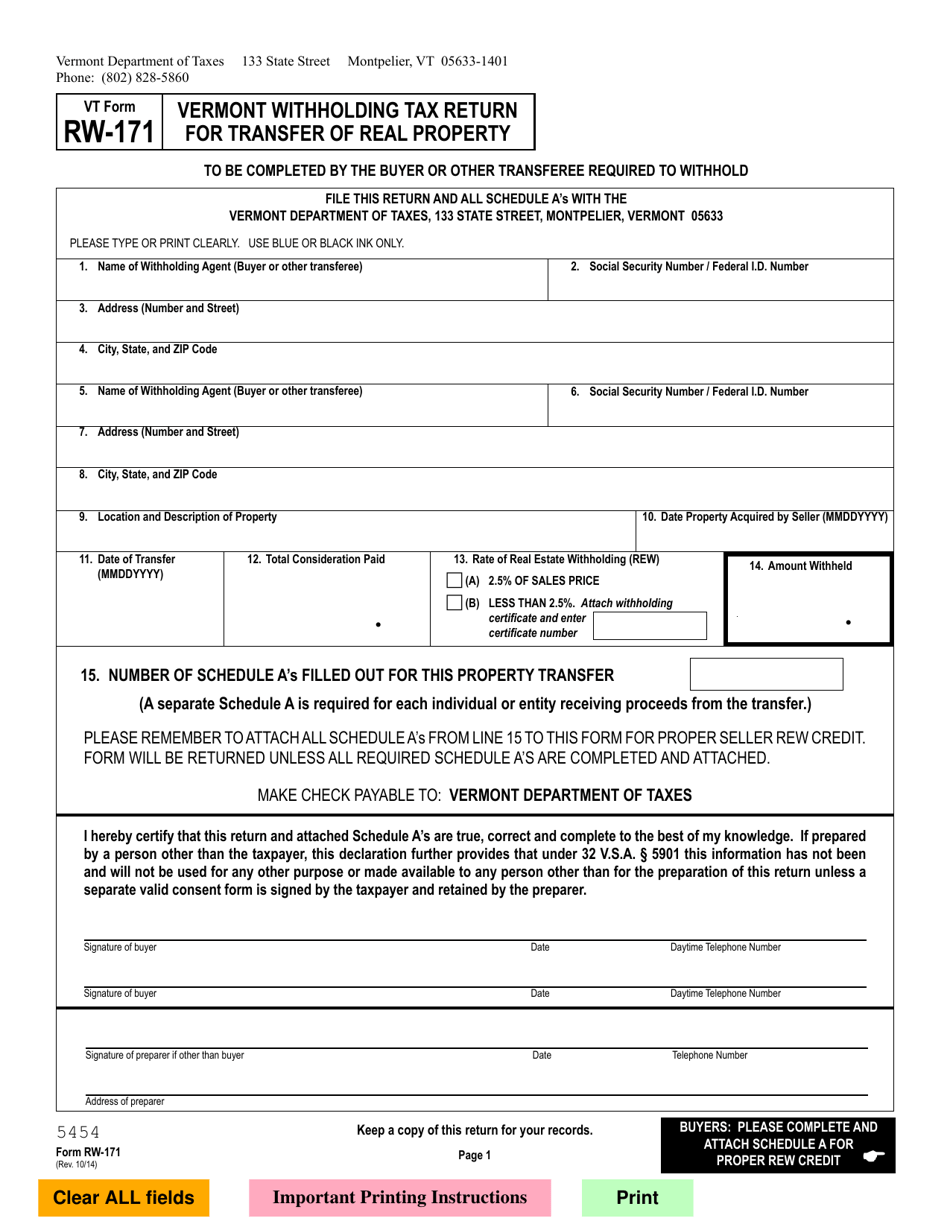

Vt Form Rw 171 Download Fillable Pdf Or Fill Online Vermont Withholding Tax Return For Transfer Of Real Property Vermont Templateroller