real estate tax shelter example

A tax shelter is a vehicle used by taxpayers to minimize or decrease their taxable incomes and therefore tax liabilities. Tax shelters can range from investments or investment.

Explore Our Sample Of Real Estate Deposit Receipt Template Receipt Template Receipt Free Receipt Template

RETs can include exemptions for certain types of buyers based on buying status or income level.

. A tax shelter as cumulatively defined by IRC Sections 448 1256 and 461 is any partnership or entity other than a C corporation that has more than 35 of losses in a tax year allocable to limited partners or limited entrepreneurs. Also known as a real estate transfer tax a real estate tax RET is a tax on passing the home title from one person to anotherSt ates counties or municipalities can impose RETs. Property Tax Bills Payments.

For the 2020 tax year you were able. As an example lets assume that a property has a cash flow of 5000 in other words the cash income from the property exceeds cash expenditures by 5000 for the year. Set Up a Retirement Account.

This is mainly due to its generous tax benefits. There are material risks associated with investing in DST properties and real estate. In this case an investor can buy a second property without paying tax on the sale of the first property.

Real estate tax shelter example. Historically real estate has proved to be a significant tax shelter. May 14 2022 minecraft mini figures series 25 codes 00420.

Exemptions Abatement Lookup. Theyve existed in their current form since 1916. Tax shelters work by reducing your taxable income thereby reducing your taxes.

To see how a real estate tax shelter works lets go through an example using a 250000 property that generates 2000mo in revenue. Find Forms for Your Industry in Minutes. Assessed Value History by Email.

After 2012 28 tax reforms brackets have changed. Here are nine of the best tax shelters you can use to reduce your tax burden. A 401 k or other type of tax-deferred retirement account like an IRA allows you to save money on taxes now by deferring to pay taxes in retirement when your income and tax bracket are likely lower.

Italian imperialism in ethiopia. So the investor has 5000 spendable cash in his or her pocket. Ad State-specific Legal Forms Form Packages for Investing Services.

To shelter real estate investment cash flow from taxes emphasize to investors that they can buy like-kind properties through tax-free exchanges also referred to as a Section 1031 exchange. As knowledgeable replacement property professionals they help clients build a customized strategy that identifies suitable investments pursuing successful completion of a 1031 Tax-Deferred Exchange. The most common tax shelter is through such retirement accounts as a 401 k 401 b Roth IRA or a Roth 401 k.

Death or wealth transfer taxes as theyre also known have been around in various forms since the early days of America. The primary purpose of a credit shelter trust is to reduce federal estate taxes levied on assets transferred to heirs. Credit Shelter Trusts and Estate Taxes.

Streamlined Document Workflows for Any Industry. WHAT IS A REAL ESTATE TAX. For singles for example from 0 to 10000 they pay 10 from 10000 to 40000 they pay 12 from 40000 to 80000 they pay 22 from 80000.

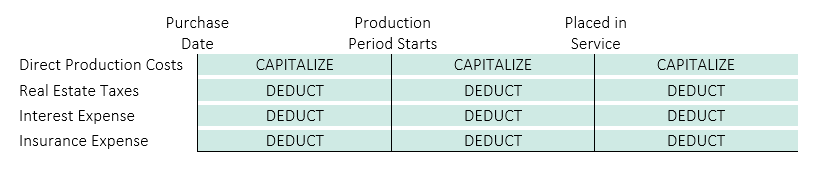

Real estate offers tax sheltering through depreciation operating expenses long-term capital gains and 1031 exchanges. A tax shelter is a method used by businesses and individuals to reduce their tax liabilities. The numbers listed below are annual.

Find Property Borough Block and Lot BBL Payment History Search. Real estate tax shelter example. A limited entrepreneur is considered any business owner who is not actively engaged in the operations or.

Ee the current RET rates across the country. Data and Lot Information. In 2022 employees can make up to 20500 in deductible contributions to a 401 k with workers age 50 and older entitled to deduct an additional 6500 in catch-up contributions.

Other tax shelters include mutual funds municipal bonds.

What Is The Biggest Tax Shelter For Most Taxpayers

Taxes For Landlords How Taxes On Rental Income Work 2022 Turbotax Canada Tips

Diy Or Hiring A Property Manager Which Is Better Property Management Real Estate Quotes Management

Fresh Cell Phone Reimbursement Policy Template Policy Template Real Estate Forms Free Basic Templates

Top Tax Deductions For Second Home Owners

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Real Estate Development When To Expense Vs Capitalize Costs Withum

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

If You Purchased A Home Last Year And It Is Your Primary Residence You May Be Entitled To A Homestead Real Estate Tax Exem New Homeowner Real Estate Estate Tax

Property Taxes City Of Pembroke

Commercial Real Estate Tax Benefits And How To Take Advantage Of Them Pioneer Realty Capital

How Is A Tax Shelter Calculated In Real Estate

Tax Shelters Definition Types Examples Of Tax Shelter

Client Contact Form Inspirational New Customer Information Sheets For Ms Word Card Template Templates Words

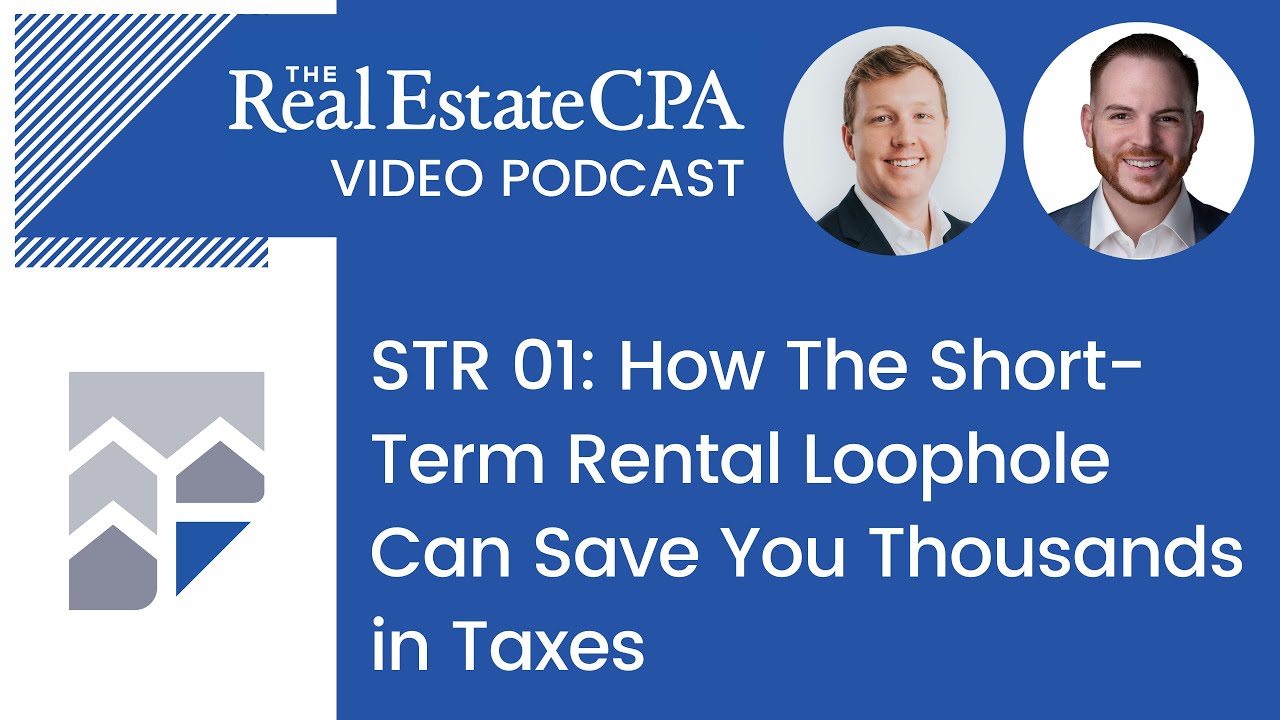

Str 01 How The Short Term Rental Loophole Can Save You Thousands In Taxes Youtube

Real Estate Purchase Agreement Property Sale Free Printable Legal Form Pdf Format Purchase Agreement Real Estate Contract Contract Template

The Fundamentals Of Canadian Estate Tax Dummies

Guarantor Form As Attachment To Lease Free Pdf Format Printable Legal Forms Real Estate Forms Form